Executive compensation refers to the total remuneration package provided to top-level executives of a company. It typically includes a base salary, bonuses, stock options, and other perks.

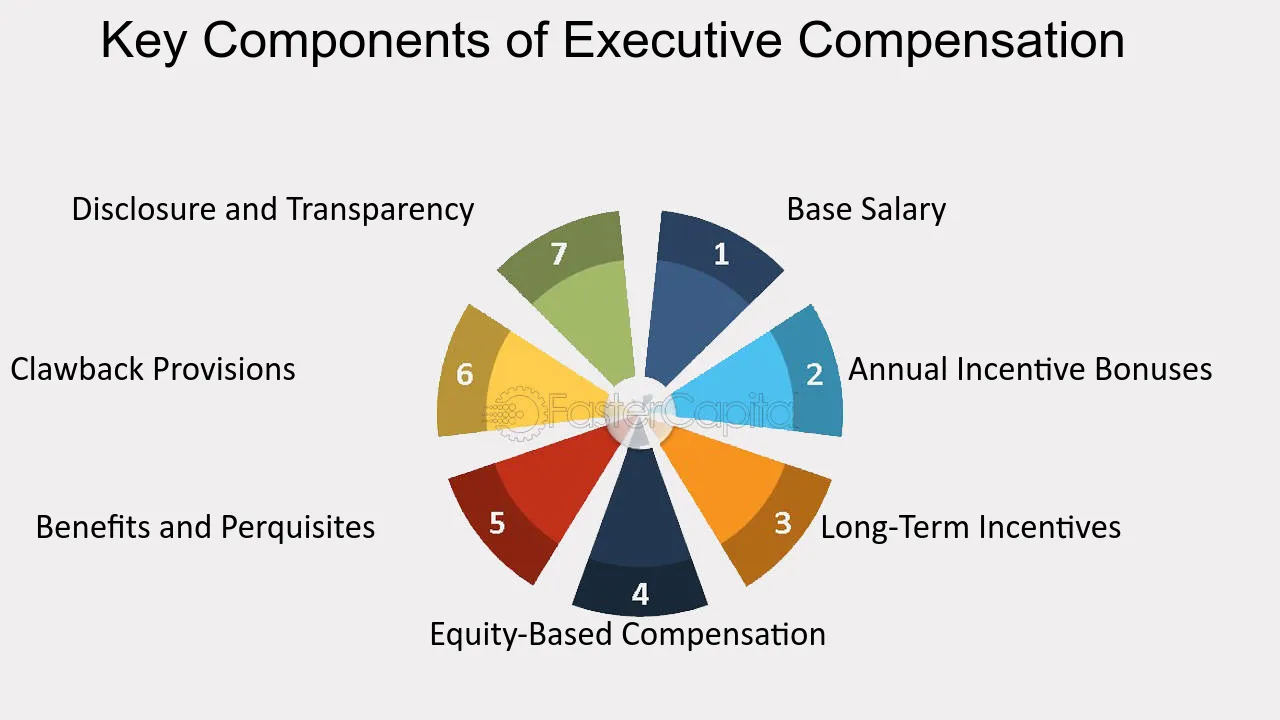

Components of Executive Compensation

- Base Salary: The fixed annual salary paid to the executive.

- Short-Term Incentives: Bonuses tied to annual performance, often measured by financial metrics like revenue, profit, or earnings per share.

- Long-Term Incentives: Stock options, restricted stock units, or performance-based stock awards that incentivize long-term performance and alignment with shareholder interests.

- Perquisites: Non-monetary benefits like company cars, housing allowances, and club memberships.

Factors Affecting Executive Compensation

Several factors influence executive compensation:

- Company Performance: The company’s financial performance and strategic goals.

- Industry Standards: Compensation practices in the industry.

- Executive Performance: The individual performance of the executive.

- Regulatory Environment: Government regulations and shareholder activism.

- Company Size and Complexity: The size and complexity of the organization.

- Board of Directors: The board’s role in setting compensation policies and approving executive pay.

Challenges in Executive Compensation

- Excessive Pay: Public scrutiny of high executive compensation, particularly during economic downturns.

- Performance Measurement: Difficulty in accurately measuring executive performance and tying it to compensation.

- Short-Termism: Overemphasis on short-term performance metrics, which may lead to risky behavior.

- Regulatory Compliance: Adherence to complex regulations and disclosure requirements.

Best Practices in Executive Compensation

- Performance-Based Pay: Tie compensation to performance metrics that align with the company’s long-term goals.

- Transparency and Disclosure: Disclose executive compensation practices to shareholders.

- Board Oversight: Ensure that the board of directors has strong oversight of executive compensation.

- External Benchmarking: Regularly benchmark executive compensation against peer companies.

- Risk Management: Consider the potential risks associated with excessive pay and implement appropriate safeguards.

- Shareholder Alignment: Ensure that executive compensation is aligned with the interests of shareholders.

By effectively managing executive compensation, companies can attract and retain top talent, motivate performance, and align executive interests with shareholder value.

Would you like to know more about a specific aspect of executive compensation, such as performance-based pay or executive perks?