What is Net Salary?

Net salary, often referred to as take-home pay, is the amount of money you actually receive after all deductions have been taken out of your gross salary. These deductions can include taxes, social security contributions, health insurance premiums, and retirement plan contributions.

Why is Net Salary Important?

- Budgeting: Understanding your net salary helps you create a realistic budget.

- Financial Planning: It’s essential for long-term financial planning, such as saving for a house or retirement.

- Decision Making: Knowing your net salary can influence major life decisions, like buying a car or starting a family.

- Negotiating Salary: While gross salary is important, net salary is what truly impacts your financial well-being.

Factors Affecting Net Salary:

Several factors can influence your net salary:

- Gross Salary: The higher your gross salary, the higher your potential net salary.

- Tax Rate: The tax rate you fall into will determine the amount of income tax withheld.

- Deductions: The number and amount of deductions will impact your net salary.

- Benefits: Employer-provided benefits, such as health insurance, can affect your net salary through payroll deductions.

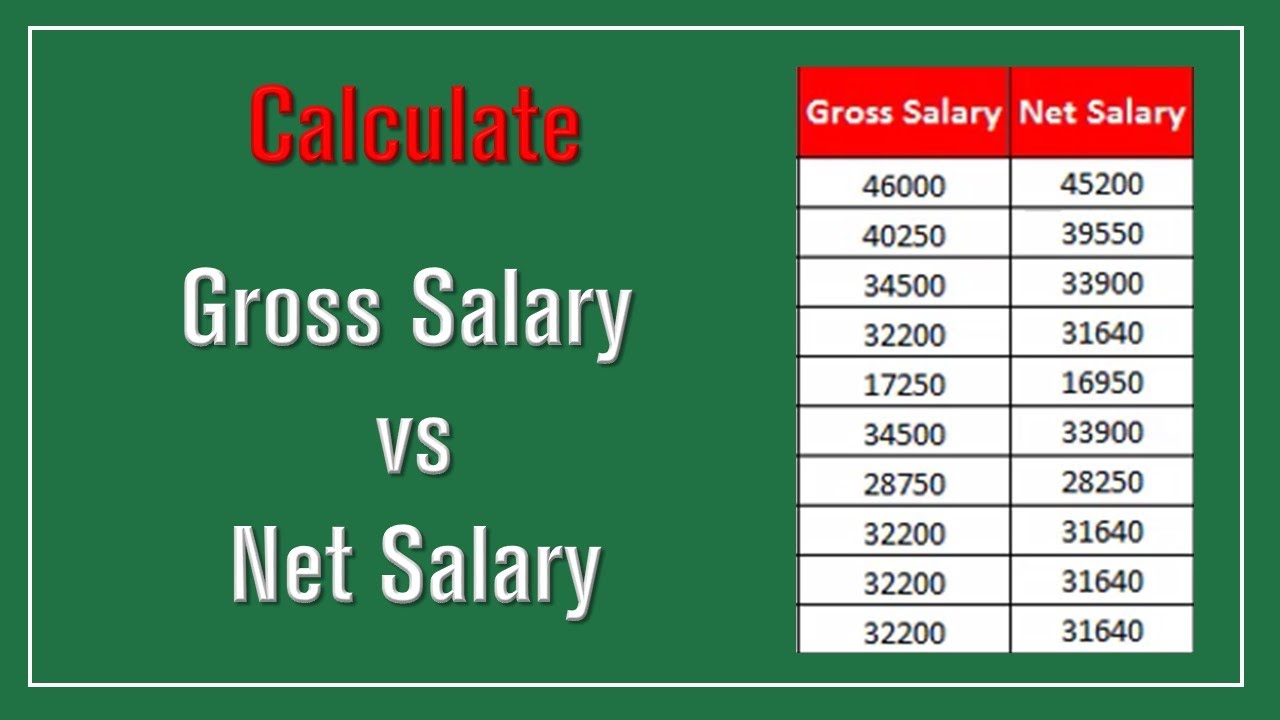

How to Calculate Net Salary:

While calculating net salary can be complex due to varying tax laws and deductions, a simplified formula can provide a basic understanding:

Net Salary = Gross Salary – Deductions

Deductions typically include:

- Federal Income Tax: A tax levied by the federal government.

- State Income Tax: A tax levied by your state government.

- Social Security Tax: A tax that funds social security programs.

- Medicare Tax: A tax that funds Medicare, a health insurance program for the elderly and disabled.

- Health Insurance Premiums: Costs associated with your health insurance plan.

- Retirement Plan Contributions: Money you contribute to retirement savings plans.

Understanding Your Pay Stub:

Your pay stub provides a detailed breakdown of your earnings and deductions. It typically includes:

- Gross Earnings: Your total earnings before deductions.

- Deductions: A list of taxes and other deductions.

- Net Pay: The amount of money you take home.

By understanding your net salary and the factors that influence it, you can make informed financial decisions and ensure that you’re maximizing your take-home pay.

Would you like to know more about a specific aspect of net salary, such as how to calculate net salary or how to maximize your take-home pay?