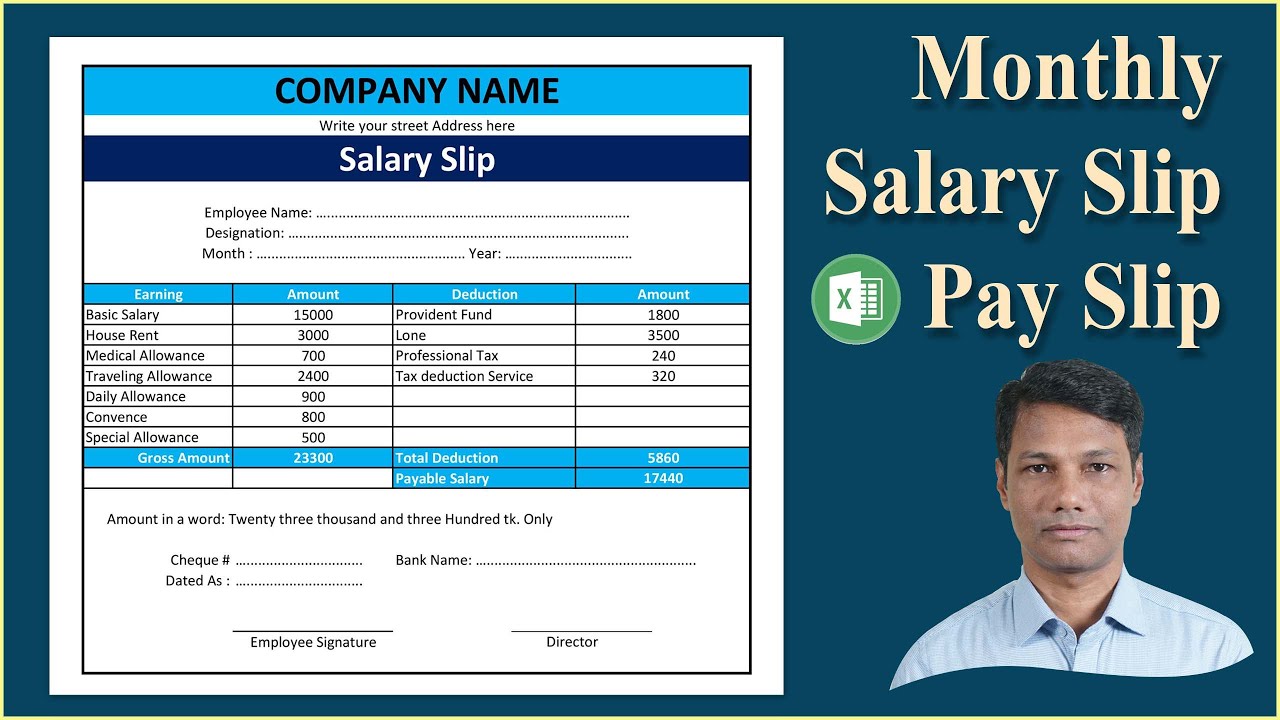

A salary slip, also known as a payslip or payslip, is a document issued by an employer to an employee, detailing their earnings and deductions for a specific pay period. It provides a clear breakdown of the amount of money an employee will receive, along with the various taxes and other deductions that have been applied.

Key Components of a Salary Slip

- Employee Information:

- Employee’s name

- Employee ID or number

- Department

- Designation

- Payment Period:

- Start date of the pay period

- End date of the pay period

- Earnings:

- Basic Salary: The fixed amount of money earned per pay period.

- Allowances: Additional payments for specific purposes, such as housing, travel, or meals.

- Overtime Pay: Extra pay for working overtime.

- Bonus: Additional payment based on performance or other factors.

- Deductions:

- Income Tax: Tax deducted from income as per government regulations.

- Professional Tax: A state-level tax on income.

- Provident Fund: A retirement savings scheme.

- Health Insurance: Premiums for health insurance coverage.

- Other Deductions: Any other deductions, such as loan repayments or union dues.

- Net Pay: The amount of money that the employee will receive after all deductions.

Importance of Understanding Your Salary Slip

- Financial Planning: Understanding your income and deductions helps you plan your finances effectively.

- Tax Planning: It helps you understand your tax liability and plan your tax payments.

- Identifying Errors: It allows you to identify any errors in your salary calculations or deductions.

- Negotiating Salary: It helps you understand your current compensation and negotiate for better pay.

By carefully reviewing your salary slip, you can ensure that your pay is accurate and that you are receiving the correct amount of compensation. If you have any questions or concerns, you should consult with your HR department or a financial advisor.

Would you like to know more about a specific aspect of salary slips, such as understanding deductions or negotiating a higher salary?